Monday, January 30, 2017 10:47 am, Posted by Absolute Destruction

We know how it sounds. How can synthetic identity theft pose a genuine concern for Canadian citizens if it isn’t real? Well, for one thing, it’s not as artificial as its name implies. Synthetic identity theft uses a mixture of authentic and fabricated information to create a completely new identity or — in some cases — even multiple identities. Unfortunately, fraudsters using this technique typically target those who have a small credit footprint, like children and the deceased, pairing their Social Insurance Numbers (SIN) with fake names, addresses, and other details. This fusion of real and false information makes it difficult to track and even easier for criminals to get fake licences, passports, and credit card accounts — which is why we here at Absolute Destruction think it’s necessary to shine a spotlight on this emerging crime.

Children, the deceased, and anyone lacking an established credit history are at risk of becoming a victim. Synthetic fraudsters target these individuals on purpose. When the genuine identity associated with a SIN has little to no credit, it also means they likely have a thin or non-existent file in the financial world. As a result, it’s incredibly easy to open accounts with these numbers, as the owners are unlikely to check their credit reports and there aren’t any security checks put in place to safeguard against fraud. They’re a blank slate waiting to be taken advantage of.

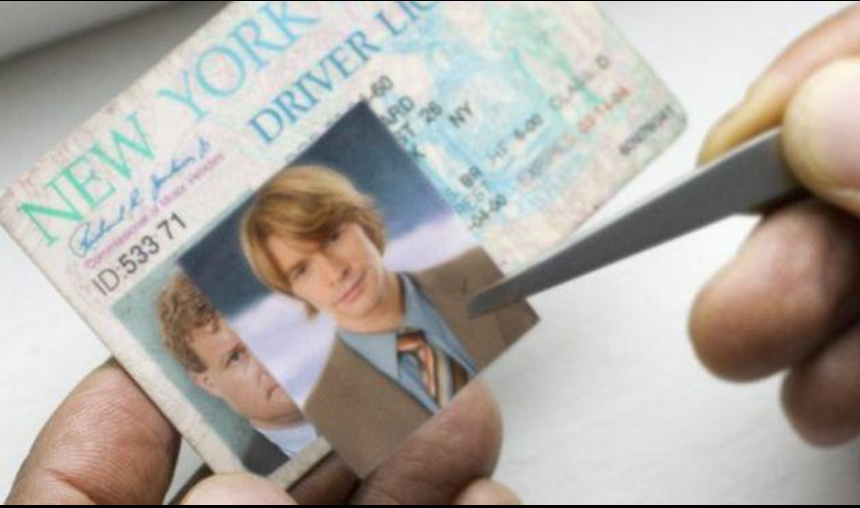

This tabula rasa creates the ideal opportunity for criminals. Using a real SIN and a fake name, they apply for a credit card. Though this initial application is more than likely denied, the process forces credit bureaus to acknowledge both the enquiry and the “person” behind the application. The fraudster has begun to create their own credit history that will make them more desirable by other organizations in the future. Eventually, they’ll be able to open multiple accounts with various institutions and fabricate what looks like a strong borrowing history on paper. With that, they can visit Service Canada to create licences and passports under fake names. In the long term, a criminal will use this established identity to open and maintain accounts with higher borrowing limits before maxing them out.

Here in Toronto, it’s a growing concern for the police. In fact, Detective Constable Mike Kelly calls the fraud ‘infinite mischief’ since criminals will encounter very few limits to their scam when using a mixture of real and fabricated information. In 2013, Equifax, a consumer credit reporting agency, estimated there were no more than 200 investigations of synthetic identity theft each month. Now they estimate that number has skyrocketed into the thousands, potentially costing Canadians a billion dollars each year.

The solution to this scam, like so many other cons, is simple: keep personal information protected. Your SIN should never leave the house, nor should it ever be shared with anyone but a trusted employer, financial institution, or the government. The same goes for your children’s or a lost loved one’s information. When you’re ready to dispose of any document that records this number or any other piece of personal information — whether it’s your own or a loved one’s — make sure it’s disposed of properly with our mobile shredders. We’ll make sure it’s incinerated so no criminal can retrieve your confidential information.

Synthetic though it may be, this method of identity theft has very real consequences for its victims. Make sure you protect yourself with safe handling of your SIN and personal information. When in doubt, give us a call to dispose of your documents.